Margin Call is a 2011 American independent drama film, written and directed by J.C. Chandor. The film has an ensemble cast that includes Kevin Spacey, Demi Moore, Paul Bettany, Jeremy Irons, Zachary Quinto, Stanley Tucci, Simon Baker, and Penn Badgley. The film takes place over a 36-hour period at a large investment bank (loosely modeled on Lehman Brothers) and focuses on the financial crisis of 2007–2008. The film follows the actions taken by a group of employees during the financial collapse. The film was first shown at the Sundance Film Festival in January 2011 and opened on October 21, 2011 in the United States.

Directed by J.C. Chandor

Produced by Robert Ogden Barnum, Michael Benaroya, Neal Dodson, Joe Jenckes, Corey Moosa, Zachary Quinto, Laura Rister & Cassian Elwes

Written by J.C. Chandor

Starring Kevin Spacey

Paul Bettany

Jeremy Irons

Zachary Quinto

Penn Badgley

Simon Baker

Aasif Mandvi

Mary McDonnell

Demi Moore

Stanley Tucci

Distributed by Roadside Attractions

Release date(s) January 25, 2011 (Sundance) & October 21, 2011 (United States)

Running time 109 minutes

Country United States

Language English

Budget $3.4–3.5 million (est.)

Box office $8,694,100 (worldwide)

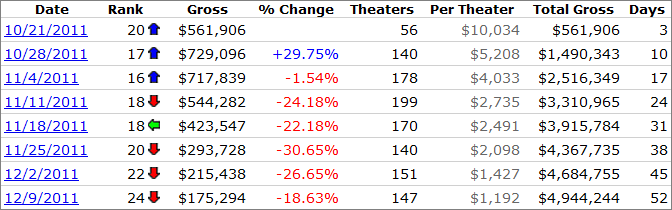

Weekend Chart Record

Preview

Story

Junior employees Seth Bregman (Penn Badgley), Peter Sullivan (Zachary Quinto) and senior fixed income salesman Will Emerson (Paul Bettany) watch as a human resources team conducts mass layoffs on their trading floor. One of the fired employees is Eric Dale (Stanley Tucci), who works in risk management. Before leaving, Dale gives Peter a USB drive with a project he had been working on, telling him to "be careful." That night, Peter finishes the project, and discovers that trading will soon exceed the historical volatility levels used by the firm to calculate risk. Because of excessive leverage, if the firm's assets in mortgage backed securities decrease by 25%, the firm will suffer a loss greater than its market capitalization. Sullivan alerts Emerson, who calls head of sales Sam Rogers (Kevin Spacey).

The employees remain at the firm all night for a series of meetings with more senior executives, including head of securities Jared Cohen (Simon Baker) and head of risk Sarah Robertson (Demi Moore), and finally CEO John Tuld (Jeremy Irons). Tuld reveals that his plan is simply to sell off all of the toxic assets before the market can react to the news of their worthlessness, thereby limiting the firm's exposure. Rogers knows this will spread the risk throughout the financial sector and will destroy the firm's relationships with its counterparties, who will never trust them again. The characters finally locate Dale, who had been missing after his company phone was turned off. Meanwhile, it is revealed that Rogers, Robertson, Cohen, and Tuld were aware of the risks in the weeks leading up to the crisis. Tuld plans to offer Robertson's resignation to the board and employees as a sacrificial lamb.

Before the markets open, Rogers tells his traders they will receive seven figure bonuses if they achieve a 93% reduction in certain MBS asset classes. He admits that the traders are effectively ending their own jobs and careers by destroying their relationships with their clients. Meanwhile, Robertson and Dale sit in an office, being paid handsomely to do nothing for the day. Emerson manages to sell off his assets, but his counterparties become increasingly agitated and suspicious as the day wears on. Having successfully reached the 93% benchmark, Rogers watches the same human resources team begin another round of layoffs on his floor. He confronts Tuld, who remarks that the current crisis is really no different from other historical panics and recessions, and sharp gains and losses are simply part of the economic cycle. He wants Rogers to stay at the firm for another two years, promising that there will be a lot of money to be made from the coming crisis. Rogers sees Sullivan meeting with Cohen about his imminent promotion, while the fates of Emerson and Bregman are not mentioned.

In the final scene, Rogers digs a hole in his ex-wife's front yard to bury his cancer-ridden dog.

Throughout the film, one of the lower-tier employees constantly makes reference to pay packages and speculates about the salaries of higher-ranked members of the firm. As the crisis unfolds, junior traders wonder what it is like to be a "real person" who does not see the impending crisis, and condemn the public for their hypocrisy of blaming Wall Street in the bad times while enjoying the easy credit and benefits of financial industry that takes risks. Dale and Sullivan are both engineers, an allusion to Wall Street's practice of luring science and engineering specialists to build and run complex trading strategies. In a series of meetings, supervisors and managers betray their ignorance of the technical details of Dale/Sullivan's findings and ask them to explain as plainly as possible.

The employees remain at the firm all night for a series of meetings with more senior executives, including head of securities Jared Cohen (Simon Baker) and head of risk Sarah Robertson (Demi Moore), and finally CEO John Tuld (Jeremy Irons). Tuld reveals that his plan is simply to sell off all of the toxic assets before the market can react to the news of their worthlessness, thereby limiting the firm's exposure. Rogers knows this will spread the risk throughout the financial sector and will destroy the firm's relationships with its counterparties, who will never trust them again. The characters finally locate Dale, who had been missing after his company phone was turned off. Meanwhile, it is revealed that Rogers, Robertson, Cohen, and Tuld were aware of the risks in the weeks leading up to the crisis. Tuld plans to offer Robertson's resignation to the board and employees as a sacrificial lamb.

Before the markets open, Rogers tells his traders they will receive seven figure bonuses if they achieve a 93% reduction in certain MBS asset classes. He admits that the traders are effectively ending their own jobs and careers by destroying their relationships with their clients. Meanwhile, Robertson and Dale sit in an office, being paid handsomely to do nothing for the day. Emerson manages to sell off his assets, but his counterparties become increasingly agitated and suspicious as the day wears on. Having successfully reached the 93% benchmark, Rogers watches the same human resources team begin another round of layoffs on his floor. He confronts Tuld, who remarks that the current crisis is really no different from other historical panics and recessions, and sharp gains and losses are simply part of the economic cycle. He wants Rogers to stay at the firm for another two years, promising that there will be a lot of money to be made from the coming crisis. Rogers sees Sullivan meeting with Cohen about his imminent promotion, while the fates of Emerson and Bregman are not mentioned.

In the final scene, Rogers digs a hole in his ex-wife's front yard to bury his cancer-ridden dog.

Throughout the film, one of the lower-tier employees constantly makes reference to pay packages and speculates about the salaries of higher-ranked members of the firm. As the crisis unfolds, junior traders wonder what it is like to be a "real person" who does not see the impending crisis, and condemn the public for their hypocrisy of blaming Wall Street in the bad times while enjoying the easy credit and benefits of financial industry that takes risks. Dale and Sullivan are both engineers, an allusion to Wall Street's practice of luring science and engineering specialists to build and run complex trading strategies. In a series of meetings, supervisors and managers betray their ignorance of the technical details of Dale/Sullivan's findings and ask them to explain as plainly as possible.

Review

Its announcement promised an inside view in the financial industry, and particularly how it could cause the recent financial crisis. And precisely this is what it did splendidly. I gave it a "very good"mark (5 out of 5) for the public prize competition when leaving the theater.

I particularly liked the way they avoided the techno babble about financial products, from which we all learned the hard way to be paper constructs only, none of these related with things in the real world. The story also clearly illustrates that higher echelons in the financial industry do not understand those technicalities either, something we assumed all along but didn't dare to ask for confirmation.

Departing from the very different purposes and backgrounds of the main characters, the story line got us involved in the attempts of each of them to cope with the situation at hand. Though their job motivations may drastically differ from yours and mine, this film had no really distinct good and bad guys.

The main characters were properly introduced in the time-line when logically needed. We got the chance to know each of them, with their own coping behavior in this volatile environmeant, yet everyone bringing along his own human characteristics. In the process we also saw the golden chains to attach each of them to the company, making it virtually impossible to cut themselves loose from this line of work. We may call it greed, but it is a fact of life that everyone gets used to incoming cash flow, however large and unnecessary it may seem in our eyes. Once being there, it is logical to buy a bigger house and to send kids to expensive schools. After that there is no easy way back, and each one smoothly grows into a life style that is difficult to escape from.

The story line as such is not that important, apart from the fact that it succeeds very well in tying all the above together. It also maintains a constant tension all the time. I consider both aspects an achievement in itself, since nothing really happens in terms of dead bodies, physical fights, and chasing cars. Only a few short scenes were shot outside, but all the rest happened in a standard office building. The final outdoor scene was a bit unexpected (I won't spoil it for you), but it shows that even bankers are human after all.

I particularly liked the way they avoided the techno babble about financial products, from which we all learned the hard way to be paper constructs only, none of these related with things in the real world. The story also clearly illustrates that higher echelons in the financial industry do not understand those technicalities either, something we assumed all along but didn't dare to ask for confirmation.

Departing from the very different purposes and backgrounds of the main characters, the story line got us involved in the attempts of each of them to cope with the situation at hand. Though their job motivations may drastically differ from yours and mine, this film had no really distinct good and bad guys.

The main characters were properly introduced in the time-line when logically needed. We got the chance to know each of them, with their own coping behavior in this volatile environmeant, yet everyone bringing along his own human characteristics. In the process we also saw the golden chains to attach each of them to the company, making it virtually impossible to cut themselves loose from this line of work. We may call it greed, but it is a fact of life that everyone gets used to incoming cash flow, however large and unnecessary it may seem in our eyes. Once being there, it is logical to buy a bigger house and to send kids to expensive schools. After that there is no easy way back, and each one smoothly grows into a life style that is difficult to escape from.

The story line as such is not that important, apart from the fact that it succeeds very well in tying all the above together. It also maintains a constant tension all the time. I consider both aspects an achievement in itself, since nothing really happens in terms of dead bodies, physical fights, and chasing cars. Only a few short scenes were shot outside, but all the rest happened in a standard office building. The final outdoor scene was a bit unexpected (I won't spoil it for you), but it shows that even bankers are human after all.

No comments:

Post a Comment